- INVENTORY FOR SMALL BUSINESS REPORT ON FED RETURN HOW TO

- INVENTORY FOR SMALL BUSINESS REPORT ON FED RETURN SOFTWARE

- INVENTORY FOR SMALL BUSINESS REPORT ON FED RETURN PLUS

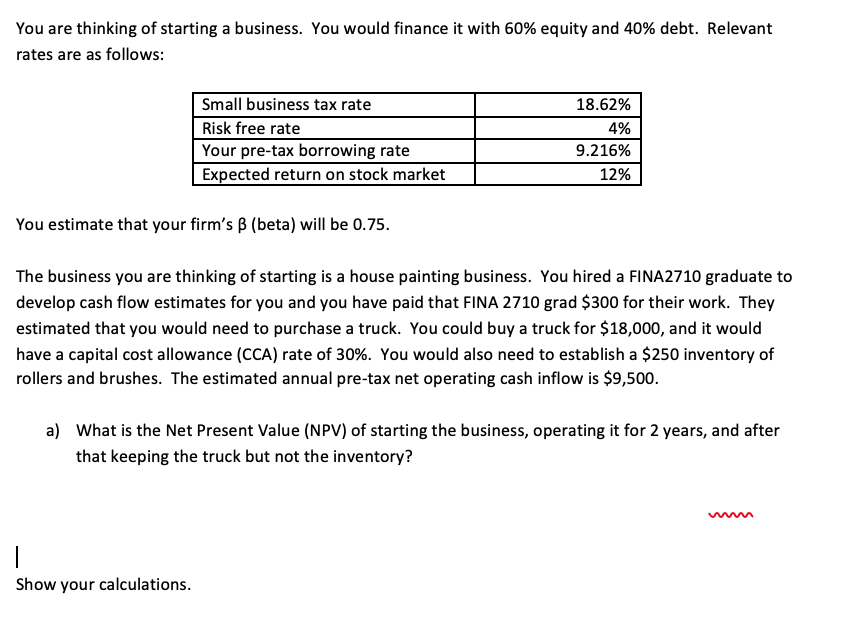

Where is my package Enter your FedEx tracking number, track by reference, obtain proof of delivery, or TCN. I have met numerous people and seen a number of occasions, when entrepreneurs over-invested in their inventory stocks thinking it would help provide a “big tax deduction” that they could use for NOLs. 18 minutes ago &0183 &32 Homeowners and businesses depend on us Choose the best order fulfillment ERP system: Start by choosing a system that offers end-to-end tracking for orders, inventory, and all other aspects of your business. Making sure you understand the difference between the two will save you a lot of heartache. If there is no increase in the cost of inventory, then there will be no benefit. Obviously, it is possible that the cost of inventory did change within a single year. Usually, inventory and expenses increase over time, thus using the last price is usually going to give you a larger reduction in gross income. Tax Planning and Reporting for a Small Business Participant Guide Small Business Financial Education Curriculum of 18 Tax Obligation Management As a small business owner, you generally will have the responsibility to pay taxes throughout the year. A partnership sends Schedule K-1, Partner’s Share of Income, Tax Credits, and Deductions out to the partners. Partners and the partnership need to report business losses and gains to the IRS.

INVENTORY FOR SMALL BUSINESS REPORT ON FED RETURN SOFTWARE

Partnerships: Partnerships file their business tax returns using Form 1065. Freestyle Solutions' small business Inventory and Order Management software works in a variety of specific industries: food & beverage, apparel, sporting goods, automotive and nutraceuticals. LIFO means that every product is sold at the “last price” paid. Certain small businesses can use a Schedule C-EZ Form. LIFO requires an attention to details because you’re trying to track the cost of inventory that you’ve purchased. This will help you decrease your gross income and as result your taxable income.Īnother way to use inventory to lower your tax liability is to use “last in, first out” or LIFO. If you know or you’re able to project your inventory needs, then you’re able to pre-purchase inventory that you know will be necessary. The best way to use inventory to reduce your tax liability is year-end planning.

Form 720 includes several pages of excise taxes that your business might have to pay and the rate. Form 720, the Quarterly Federal Excise Tax Return, is used to report on federal excise taxes collected by the business for a variety of products and services.

INVENTORY FOR SMALL BUSINESS REPORT ON FED RETURN HOW TO

What is used to calculate the income tax obligation of a small business a. How to Report, Pay, and File Federal Excise Taxes.

INVENTORY FOR SMALL BUSINESS REPORT ON FED RETURN PLUS

You can even report at an item level whether you’re spending on feed, fertiliser or fuel.A tax deduction may result in “negative taxable income” or a NOL. Tax Planning and Reporting for a Small Business Participant Guide Small Business Financial Education Curriculum of 18 Pre-Test Test your knowledge of tax planning and reporting before going through the course. Your beginning inventory plus the items you buy each year minus your ending inventory form your Cost of Goods Sold (COGS). Inventory is sometimes described as the products your company sells, but it’s also the raw materials used to make your products. Count all types of inventory, not just products you sell. If you’re wondering how to best organize your small business inventory, the below tips might help: 1.

ReportingĮasily track your profit and losses, cashflow, analyse your income and expenditure in more detail. Eight tips for small business inventory organization. Use features available for smoothing, averaging and applying percentage increases and decreases on a line by line basis. Today, the use of computer systems to control inventory is far more feasible for small business than. BankLink allows you to report on actuals against budget and forecast for the future. After carrier/inspector prepares damage report.

Budgetsīudgeting is invaluable for rural businesses. Flexibility allows the users to add a chart of accounts that covers all of the categories they need. We also allow dissections, so the correct amount can be allocated to the correct farm trading account. Dissections on transactions or journal entriesīankLink allows you or your accountant to track stock purchases and sales – you can even track quantities in more detail.Track stock, ensuring that you provide:.To meet your IRD requirements every rural business needs to:

0 kommentar(er)

0 kommentar(er)